China’s 3rd Plenum—Three Takeaways for Latin America

Margaret Myers and Yifang Wang

Jul 26, 2024

https://www.thedialogue.org/blogs/2024/07/chinas-3rd-plenum-three-takeaways-for-latin-america/

The Chinese Communist Party (CCP) has released over three hundred pages of “decisions” from its third plenary meeting (“3rd Plenum”), which concluded on July 18. The meeting itself, and resulting decisions document, were met with a lukewarm response from the international investment community, as most hoped for a clearer roadmap for addressing long-standing real estate and employment concerns, among other structural challenges. Instead, the decisions largely signal continuity—or a doubling down on China’s present course of action—which will rely heavily on supply-side policies targeting high-tech and high-end manufacturing to boost China’s economic prospects.

Though not a course correction, China’s “decisions” will nevertheless have wide-ranging global implications, as the CCP, government, and industry all work to put China’s newest economic blueprint into practice. Indeed, the Party’s growth agenda is likely to depend more than ever on economic engagement and partnership with developing regions, including much of Latin America, as critical markets for and partners in high-tech supply chain development.

The following three key takeaways from the 2024 3rd Plenum “decisions” are potentially impactful for the region:

China is betting on high-tech manufacturing to ensure long-term economic growth. The effects of this process are already visible in Latin America.

The 3rd Plenum “decisions,” a more than 20,000-character-long reform agenda outlined by the CCP Central Committee, are aligned with Xi Jinping’s vision of “China-style modernization,” which ventures beyond a decades-long process of learning from the West, experimenting with policy solutions, and “feeling the stones,” so to speak, to the adoption of a much more bold and China-specific agenda that is “freed from the traditional economic growth mode and productivity development paths.”

China is determined to chart its own course, in other words—albeit through heavily state-led industrial policy initiatives. Central to this approach are what Xi has called “new quality productive forces,” or the pursuit of high-tech, high-efficiency, and high-quality to bolster economic growth. In practice, this has translated to an intense focusing of Chinese effort on boosting competitiveness in strategic sectors, such as solar, batteries, and electric vehicles, including by encouraging overproduction and overcapacity in these industries.

China is staying the course, according to §8 of the 2024 decisions, which suggests continued institutional and financial guarantees (possibly in the form of subsidies or easier access to credit) in support of next-generation industries such as information technology, artificial intelligence, aviation and aerospace, new energy, new materials, high-end equipment, biomedicine, and quantum technology.

Latin America and other developing regions will play a central role in this process. As parts of the so-called Global North restrict market access for China’s high-tech output, Latin America and other developing regions are becoming increasingly important markets for Chinese exporters. Chinese EV sales to Latin America grew by 300 percent from 2022 to 2023, according to China Customs data. With end-to-end supply chain development in mind, the 2024 decisions emphasize the continued facilitation of “international cooperation in industrial and supply chains.”

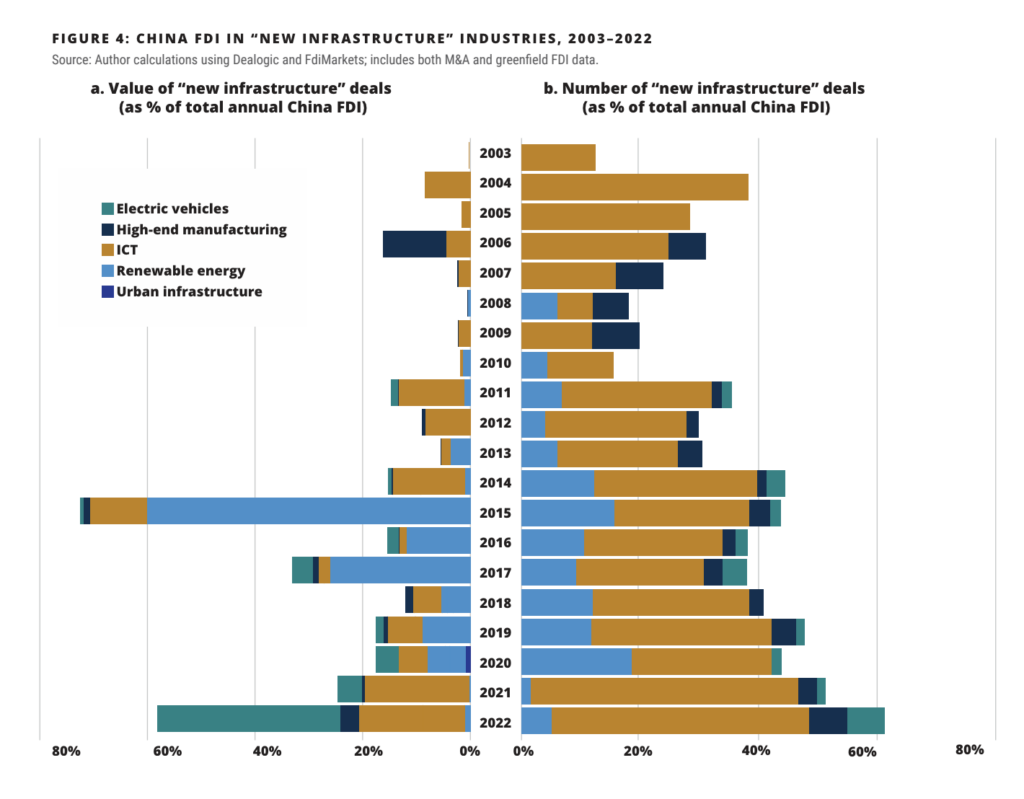

China’s

foreign direct investment (FDI) in Latin America is also increasingly

focused on generating markets for its high-tech goods and services. Our data

suggest an upward trend for Chinese FDI in LAC in so-called “new

infrastructure” industries, with ICT, renewable energy technology, and,

increasingly, electric vehicles accounting for the bulk of this

activity. Whether in terms of value or number of deals, Chinese FDI in

these industries is on the rise, accounting for 58 percent (around

$3.7 billion) of total annual Chinese FDI in the region in 2022 and over

60 percent of the total number of FDI deals announced by Chinese

companies that year. The region’s supply critical metals and minerals is

also of considerable interest to China as it looks to consolidate its

position across battery supply chains.

China’s provinces and municipalities will play an ever more important role in China-Latin America relations.

China-Latin America ties are forged by a tangled web of overlapping interactions and a kaleidoscopic cast of characters, with government, Party, quasi-governmental, and commercial actors all playing prominent roles. Chinese provinces and cities are also increasingly important actors in China’s local-level engagement with LAC, often through “twinning,” or sister cities/provinces arrangements. The extensive and long-standing relationships between Chile’s Coquimbo region and Henan province and Argentina’s Jujuy province and Guizhou province are well-documented in the 2020 Inter-American Dialogue report, Going Local: An Assessment of China’s Administrative-Level Activity in Latin America and the Caribbean, for instance.

As it stands, China’s 2024 decisions may very well prompt more engagement from China’s localities with parts of the Latin American region. To place more fiscal resources at the disposal of local governments, China will “expand the sources of tax revenue at the local level and grant greater authority for tax management to local governments as appropriate.” In theory, this means that Chinese localities will rely on their respective tax bases (including their companies) for more revenue and to address their debt issues. This dynamic may very well drive more company-led, overseas activity in sectors of top importance to China, furthering a process of localization that is already well underway in the China-Latin America dynamic.

China’s industrial strategy will be met with resistance, including in parts of Latin America.

China’s reform agenda is expansive and ambitious, and its implementation will continue to be met with strong headwinds, as China “braves uncharted waters” and “ventures into dangerous shoals,” as the decisions document puts it. Even if “new quality productive forces” boost domestic growth prospects, China will continue to grapple with its real estate bubble and related, highly indebted local government financing vehicles, among other pressing challenges.

China’s headwinds will also blow from abroad. As China doubles down on science and tech production, efforts to offload overcapacity in strategic sectors will be met with ongoing resistance among competitor industries—in the “Global North,” certainly, but also in parts of Latin America. Mexican, Chilean, and Brazilian steel tariffs were a recent reaction to China’s efforts to offload part of its extensive overcapacity. Brazil’s EV tariffs, though largely symbolic, are another example of regional resistance to booming Chinese exports. The impact on Latin American manufacturers will no doubt grow as Chinese policymakers aim to boost their competitiveness in more sectors, such as semiconductors, medical equipment, and machine tools.